jacksonville fl vehicle sales tax

Florida collects a 6 state sales tax rate on the purchase of all vehicles. However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in.

Used Chevrolet Tahoe For Sale In Jacksonville Fl Edmunds

Method to calculate Jacksonville sales tax in 2022 As we all know there are different sales tax rates from state to city to your area and everything combined is the required.

. This includes the rates on the state county city and special levels. This document can be downloaded from the official DHSMV. All transfers of ownership must be completed within 30 days of the date the vehicle is assigned by the seller or a 2000 fee is levied at the time of.

Sales tax will be collected if applicable. In addition Florida allows for local governments to charge a tax of up to 15. Sales Tax on Motor Vehicles Brought into Florida New and used cars purchased in the State of Florida are.

A deposit in the amount of 10 of the total value of certificates you wish to purchase must be received by the dates stated on the tax sale website. Did South Dakota v. Higher sales tax than any other Florida locality Jacksonville collects the maximum legal local sales tax The 75 sales tax rate in Jacksonville consists of 6 Florida state sales tax and.

The Jacksonville sales tax rate is. Sales tax is added to the price of taxable goods or services and collected from the purchaser at. Depending on the zipcode the sales tax rate of Jacksonville may vary from 6 to 7.

Corporate Income Tax File and Pay. The Florida sales tax rate is currently. Name omitted was the owner of TNS Auto Sales Inc.

File and Pay Taxes and Fees. The December 2020 total local sales tax rate was 7000. Jacksonville FL Sales Tax Rate FL Sales Tax Rate The current total local sales tax rate in Jacksonville FL is 7500.

Documentary Stamp Tax - Registered. A used car dealership located at 9171 103 rd. Florida charges a statewide sales tax of 6 on the purchase of all cars new or used.

The County sales tax rate is. Wayfair Inc affect Florida. The Jacksonville Florida general sales tax rate is 6.

The average cumulative sales tax rate in Jacksonville Florida is 75. Sale of 20000 motor vehicle to a resident of another state where the sales tax rate on motor vehicles is 7. Jacksonville has parts of it located within Duval.

Florida sales tax is due at the rate of 6 on the 20000 sales price of the. Its official name is Notice of Sale andor Bill of Sale for a Motor Vehicle Mobile Home Off-Highway Vehicle or Vessel. Corporate Income Tax Additional Required Information.

The 2018 United States Supreme. Each sale admission storage or rental in Florida is taxable unless the transaction is exempt. The sales tax rate in the state of Florida is 6.

For example if you wish to purchase. On November 14 2014 name omitted was arrested for sales tax fraud. Every 2018 combined rates.

Davie FL Sales Tax Rate.

Used Chevrolet Suburban For Sale In Jacksonville Fl Edmunds

New 6 X 12 X 48 Dump Trailers 8 Lug 14 000 Lb Axle Top Shelf Trailers Dump Trailers Roll Off Trailers Dump Trailers In Jacksonville Fl Dump Trailer Dealer

Enterprise Car Sales Home Facebook

New Chevrolet Vehicles For Sale In Jacksonville

Duval Schools Half Cent Sales Tax Launched A Year Ago Here S What S Happened

Classic Cars For Sale In Jacksonville Fl Cargurus

Jacksonville Backs Needed School Sales Tax

Used Trucks For Sale In Jacksonville Fl Arlington Toyota

How To Register A Car In Florida

Junk Car Salvaging And Selling In Jacksonville For Cash

Cheap Cars For Sale In Jacksonville Fl Cargurus

New Chevy Tahoe For Sale In Jacksonville Fl

New 2022 Hyundai Venue Limited For Sale In Jacksonville Fl Kmhrc8a33nu168412

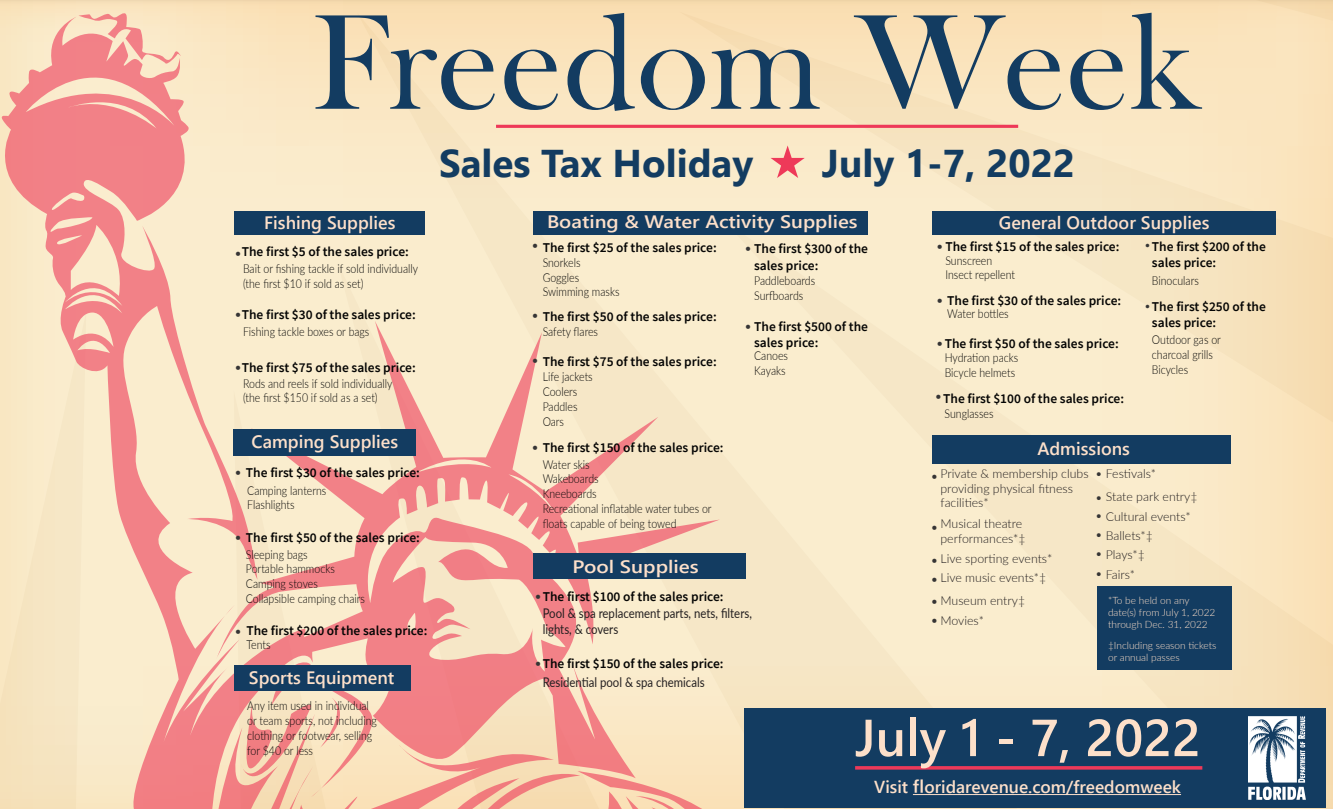

Freedom Week In Florida Here S What You Can Buy Without Paying Sales Tax